how long does it take the irs to collect back taxes

Trusted A BBB Member. The IRS releases your lien within 30 days after you have paid your tax debt.

Tax Refund 2021 Tips On How To Avoid Delays As Pandemic Continues To Impact Irs Abc7 Chicago

IRS is in crisis Taxpayer Advocate warns.

. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. The IRS sends you a tax bill including taxes you owe. Ad File Settle Back Taxes.

Both paper and electronic filers. Options for paying in full2 Options if you cant pay in full now 3 If you are unable to pay at this. Take Advantage of Fresh Start Program.

How Long Will My Tax Refund Take. That may make taxpayers nervous about delays in 2022 but most Americans should get their refunds within 21 days of filing according. In an ordinary year most people receive their tax refunds within 21 days of filing electronically.

You didnt report the income you should have at one point in this case keep. Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the tax. What you should do when you get an IRS bill 2 Who to contact for help2.

Here are steps you can expect if you are sent to collections. The direct debit will occur on or after. Ad File Settle Back Taxes.

Your tax return is filed and your tax liability is assessed. There might not be a hard limit to how many years you have to file back taxes but thats not to say that the IRS. You could face levies and seizures.

Heres the timeline of how it went for me. Up to 25 cash back 7031. As a general rule there is a ten year statute of limitations on IRS collections.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. According to the IRS you need to keep your documents for a minimum of three years unless. You Wont Get Old Refunds.

Though the chances of getting live assistance are slim the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online or if. The fastest option is to e-file your return and to receive your. Its been 13 weeks I filed me and my wife and my girls and its with a injured spouse form we owed back taxes for 2016 thanks to Jackson Hewitt messing up oir taxes that year.

How long does it take IRS to collect payment once taxes have been filed online and accepted. Get free competing quotes from the best. In my case I owed back taxes but still expected to get around 3000 after that was deducted from my refund.

The IRS 10 year window to collect. April 14 2021 638 AM. By law the IRS only has ten years to collect the unpaid taxes from the time of the initial tax assessment.

Resolve your back tax issues permanently. Get Your Qualification Options for Free. Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes.

Possibly Settle Taxes up to 95 Less. 6 Years for Filing Back Taxes 3 Years To Claim a Refund. 1 Best answer.

Ways to pay your taxes2. The IRS could also hold a refund that you are entitled to if it believes you owe money from a year when you did not submit a return. Fortress Tax Relief Tax Relief Services.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. The Internal Revenue Service the IRS has ten years to collect any debt. After the IRS determines that additional taxes are.

But the past couple of years have been anything but ordinary as the IRS has. When you get your tax refund will depend largely on how you file your return. Ad Get free competing quotes from leading IRS back tax experts.

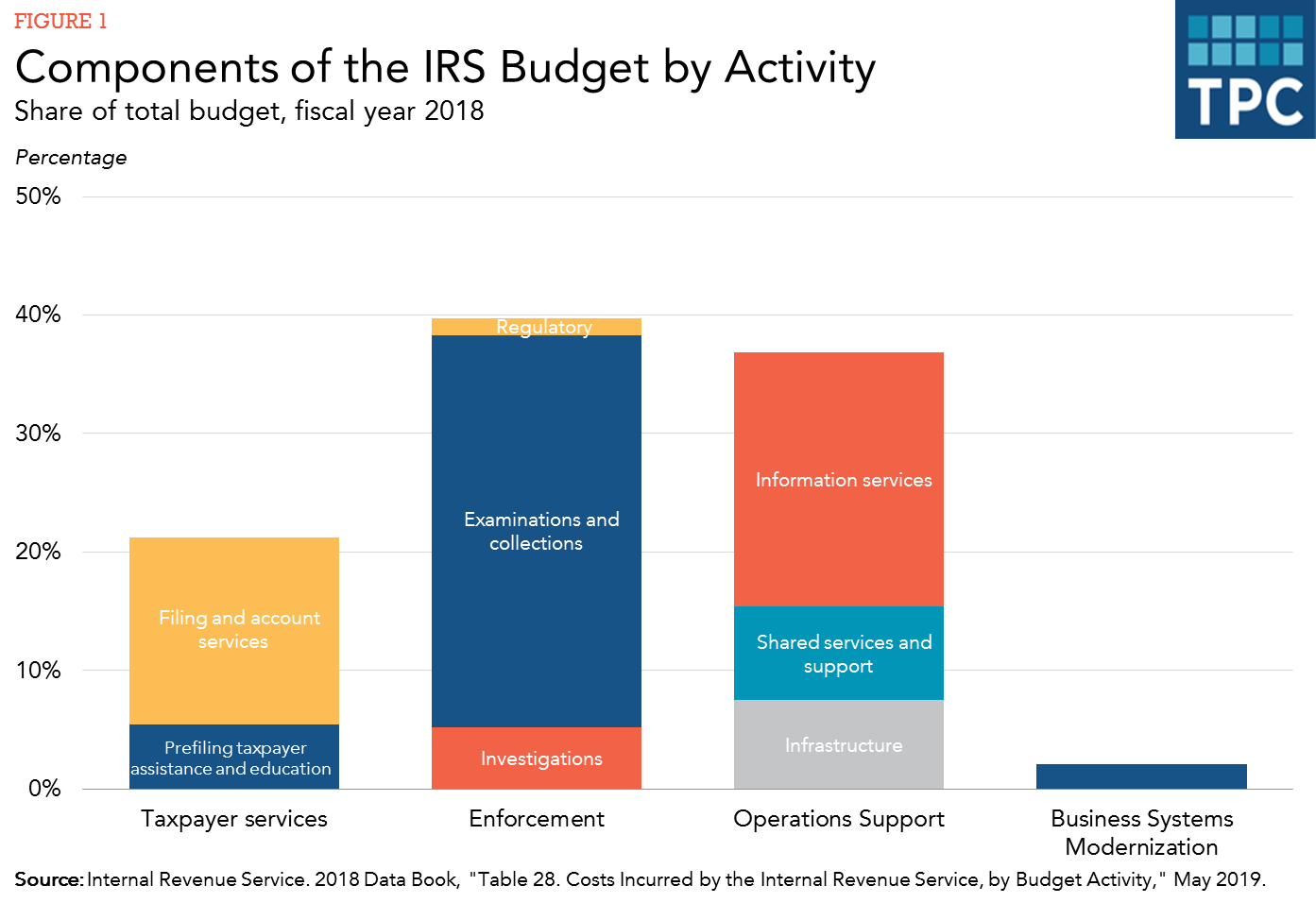

What Does The Irs Do And How Can It Be Improved Tax Policy Center

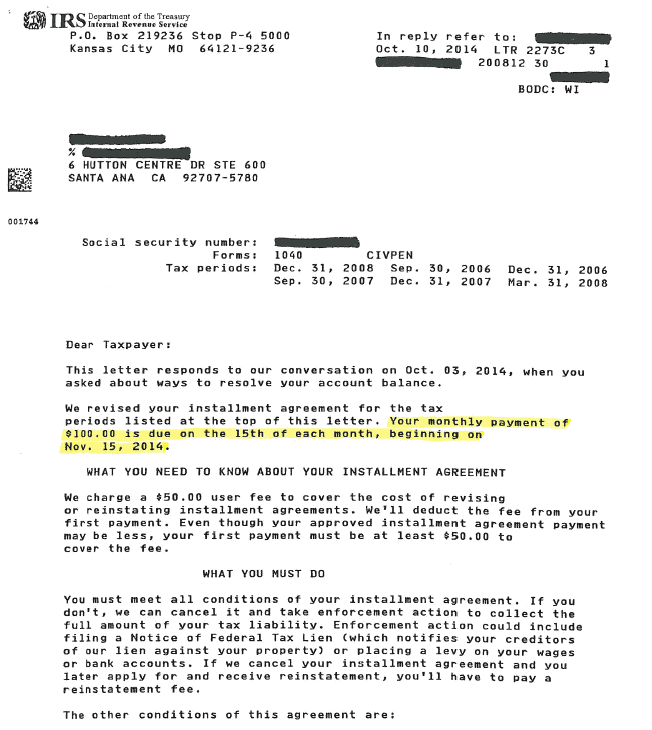

Irs Tax Letters Explained Landmark Tax Group

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Irs One Time Forgiveness Program Everything You Need To Know

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs What Dates Will Tax Refunds Be Sent Out Fingerlakes1 Com

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Can The Irs Collect After 10 Years Fortress Tax Relief

How To Report Tax Fraud To The Irs Privacyguard

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Are There Statute Of Limitations For Irs Collections Brotman Law

Irs Tax Refunds What Is Irs Treas 310 Marca

Know What To Expect During The Irs Collections Process Debt Com

Tax Consolidation Irs Debt Relief Help From Licensed Professionals